All Categories

Featured

Table of Contents

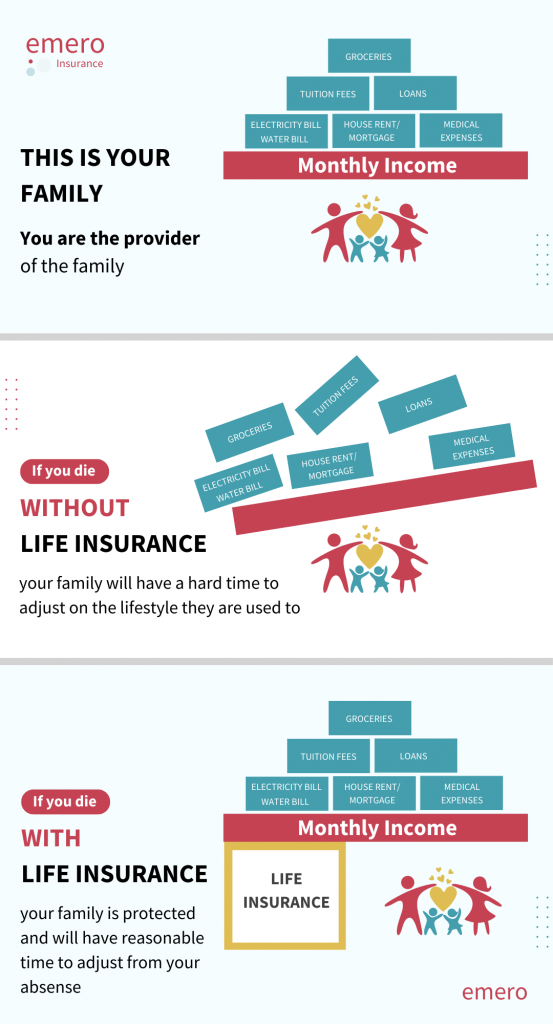

Below's just how both contrast. Both mortgage security insurance coverage (MPI) and life insurance policy are optional policies that offer some economic defense to loved ones if you die. The vital difference: MPI coverage pays off the remaining equilibrium on your home loan, whereas life insurance coverage provides your beneficiaries a fatality benefit that can be made use of for any function.

The majority of plans have a maximum restriction on the size of the home loan balance that can be guaranteed. This maximum quantity will certainly be discussed when you apply for your Mortgage Life Insurance Policy, and will certainly be documented in your certification of insurance policy. Even if your beginning home loan equilibrium is greater than the maximum limit, you can still guarantee it up to that limitation.

They likewise like the truth that the earnings of her mortgage life insurance policy will go straight to pay the home loan equilibrium instead of possibly being made use of to pay various other financial obligations. mortgage term life. It's essential to Anne-Sophie that her family will have the ability to continue residing in their household home, without monetary duress

However, keeping every one of these acronyms and insurance coverage types right can be a frustration. The following table places them side-by-side so you can quickly separate among them if you obtain perplexed. An additional insurance policy coverage kind that can repay your home mortgage if you pass away is a basic life insurance policy plan.

Mortgage Related Life Insurance

A is in area for a set number of years, such as 10, 20 or 30 years, and pays your recipients if you were to pass away throughout that term. A supplies protection for your entire life period and pays out when you pass away.

One typical rule of thumb is to aim for a life insurance plan that will certainly pay as much as ten times the policyholder's salary amount. You may select to make use of something like the Penny technique, which adds a family members's debt, earnings, home mortgage and education and learning costs to determine exactly how much life insurance policy is needed.

There's a reason brand-new homeowners' mailboxes are frequently bombarded with "Last Possibility!" and "Urgent! Activity Needed!" letters from home loan security insurance companies: Lots of only permit you to buy MPI within 24 months of closing on your home mortgage. It's additionally worth keeping in mind that there are age-related restrictions and limits enforced by almost all insurance firms, that frequently will not provide older buyers as lots of alternatives, will certainly bill them extra or might deny them outright.

What Is Mortgage Life And Disability Insurance

Here's just how home mortgage defense insurance gauges up against typical life insurance coverage. If you're able to qualify for term life insurance coverage, you need to avoid mortgage protection insurance policy (MPI).

In those situations, MPI can provide wonderful assurance. Just make sure to comparison-shop and check out every one of the small print before enrolling in any policy. Every home loan defense choice will certainly have many rules, regulations, advantage options and disadvantages that require to be considered thoroughly versus your accurate scenario.

A life insurance policy plan can help settle your home's mortgage if you were to die. It is just one of several manner ins which life insurance may aid protect your loved ones and their economic future. One of the most effective ways to factor your home loan right into your life insurance need is to chat with your insurance policy agent.

Rather than a one-size-fits-all life insurance policy policy, American Domesticity Insurer provides policies that can be developed specifically to satisfy your household's needs. Below are several of your alternatives: A term life insurance coverage plan (insurance that pays off the mortgage in case of death) is active for a specific amount of time and commonly provides a larger quantity of protection at a lower price than an irreversible plan

Instead than only covering a set number of years, it can cover you for your whole life. It additionally has living benefits, such as money worth accumulation. * American Family Life Insurance coverage Business supplies different life insurance coverage plans.

Your agent is a great resource to answer your questions. They may also have the ability to help you find voids in your life insurance protection or brand-new methods to conserve on your various other insurance plan. ***Yes. A life insurance policy recipient can pick to utilize the survivor benefit for anything. It's a fantastic means to aid protect the economic future of your family if you were to die.

Bank Mortgage Insurance Vs Life Insurance

Life insurance policy is one method of helping your household in settling a mortgage if you were to die prior to the home loan is completely repaid. No. Life insurance coverage is not mandatory, yet it can be a crucial part of assisting make certain your enjoyed ones are financially safeguarded. Life insurance policy proceeds might be made use of to aid repay a mortgage, however it is not the like mortgage insurance policy that you could be needed to have as a problem of a car loan.

Life insurance may aid guarantee your residence remains in your family members by offering a fatality advantage that might help pay down a home loan or make crucial purchases if you were to pass away. This is a brief summary of insurance coverage and is subject to policy and/or cyclist terms and conditions, which may differ by state - mortgage insurance to pay off house in case of death.

Mortgage Redundancy Cover

Words life time, lifelong and irreversible are subject to plan conditions. * Any type of lendings taken from your life insurance policy plan will accumulate interest. Any type of outstanding loan balance (loan plus interest) will be deducted from the death advantage at the time of case or from the cash money value at the time of surrender.

** Based on plan conditions. ***Price cuts might vary by state and firm financing the car or house owners policy. Price cuts might not put on all coverages on a car or property owners policy. Discounts do not put on the life policy. Plan Forms: ICC18-33 (10 ), ICC18-33 (15 ), ICC18-34 (20 ), ICC18-35 (30 ), L-33 (10 )(ND), L-33 (15 )(ND), L-34 (20 )(ND), L-35 (30 )(ND), L-33 (10 )(SD), L-33 (15 )(SD), L-34 (20 )(SD), L-35 (30 )(SD), ICC18-36 (10 ), ICC18-36 (15 ), ICC18-36 (20 ), ICC18-36 (30 ), L-36 (10 )(ND), L-36 (15 )(ND), L-36 (20 )(ND), L-36 (30 )(ND), L-36 (10 )(SD), L-36 (15 )(SD), L-36 (20 )(SD), L-36 (30 )(SD), ICC17-225 WL, L-225 (ND) WL, L-225 WL, ICC17-227 WL, L-227 (ND) WL, L-227 WL, ICC17-223 WL, L-223 (ND) WL, L-223 WL, ICC17-224 WL, L-224 (ND) WL, L-224 WL, ICC17-228 WL, L-228 (ND) WL, L-228 WL, ICC21, L141, MS 01 22, L141, ND 02 22, L141, SD 02 22.

Home mortgage defense insurance policy (MPI) is a various kind of secure that could be handy if you're incapable to repay your mortgage. Home loan protection insurance policy is an insurance coverage plan that pays off the remainder of your home mortgage if you pass away or if you become handicapped and can't function.

Like PMI, MIP secures the lender, not you. Nonetheless, unlike PMI, you'll pay MIP for the duration of the lending term, in many cases. Both PMI and MIP are needed insurance policy protections. An MPI policy is completely optional. The quantity you'll spend for home mortgage protection insurance coverage depends upon a selection of aspects, consisting of the insurance company and the current balance of your home mortgage.

Still, there are pros and disadvantages: A lot of MPI policies are issued on a "ensured acceptance" basis. That can be helpful if you have a health and wellness problem and pay high prices forever insurance or struggle to obtain protection. An MPI policy can supply you and your family with a complacency.

What Is The Difference Between Home Insurance And Mortgage Insurance

You can choose whether you require home loan defense insurance and for just how lengthy you require it. You might desire your home mortgage protection insurance term to be close in length to exactly how long you have actually left to pay off your mortgage You can terminate a mortgage protection insurance coverage policy.

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Insurance Funeral Plans

Metlife Term Life Insurance Instant Quote