All Categories

Featured

Table of Contents

- – What does Guaranteed Level Term Life Insurance...

- – What is Level Term Life Insurance Protection?

- – Can I get What Is Level Term Life Insurance? ...

- – What is a simple explanation of Compare Level...

- – What is the process for getting Level Term L...

- – Who are the cheapest Level Term Life Insuran...

- – How can I secure Level Death Benefit Term Li...

The main differences in between a term life insurance policy policy and a long-term insurance plan (such as whole life or universal life insurance policy) are the duration of the plan, the build-up of a cash value, and the price. The appropriate selection for you will depend on your needs. Here are some points to think about.

People who own entire life insurance policy pay much more in costs for much less protection but have the protection of understanding they are shielded for life. Level term life insurance rates. Individuals that buy term life pay costs for an extensive duration, but they obtain nothing in return unless they have the tragedy to pass away before the term runs out

The efficiency of permanent insurance coverage can be consistent and it is tax-advantaged, supplying added benefits when the stock market is volatile. There is no one-size-fits-all solution to the term versus irreversible insurance coverage discussion.

The biker guarantees the right to transform an in-force term policyor one ready to expireto a permanent plan without going with underwriting or showing insurability. The conversion cyclist ought to allow you to convert to any type of irreversible policy the insurer supplies without constraints. The key features of the cyclist are keeping the initial wellness ranking of the term policy upon conversion (even if you later have wellness problems or become uninsurable) and making a decision when and exactly how much of the insurance coverage to convert.

What does Guaranteed Level Term Life Insurance cover?

Of training course, total premiums will certainly increase considerably since entire life insurance policy is more costly than term life insurance - What is level term life insurance?. Clinical conditions that create during the term life duration can not create premiums to be increased.

Term life insurance policy is a relatively inexpensive way to provide a lump sum to your dependents if something happens to you. If you are young and healthy, and you sustain a family members, it can be a good alternative. Whole life insurance features substantially higher monthly costs. It is meant to offer insurance coverage for as long as you live.

It relies on their age. Insurer established an optimum age limit for term life insurance policy policies. This is normally 80 to 90 years old, but might be higher or reduced depending on the company. The costs additionally increases with age, so a person aged 60 or 70 will pay significantly more than somebody decades younger.

Term life is somewhat comparable to auto insurance policy. It's statistically unlikely that you'll require it, and the premiums are cash away if you do not. Yet if the worst occurs, your family members will obtain the benefits.

What is Level Term Life Insurance Protection?

A degree costs term life insurance policy plan lets you stick to your budget while you aid protect your family. Unlike some stepped rate plans that enhances annually with your age, this type of term plan supplies prices that remain the exact same through you pick, also as you get older or your health adjustments.

Learn much more about the Life insurance policy options available to you as an AICPA member. ___ Aon Insurance Policy Providers is the brand name for the broker agent and program management operations of Fondness Insurance policy Solutions, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Firm, Inc. (CA 0795465); in OK, AIS Affinity Insurance Providers Inc.; in CA, Aon Fondness Insurance Coverage Solutions, Inc.

Can I get What Is Level Term Life Insurance? online?

The Plan Agent of the AICPA Insurance Policy Trust Fund, Aon Insurance Services, is not associated with Prudential. Team Insurance policy coverage is provided by The Prudential Insurance Provider of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

Essentially, there are 2 kinds of life insurance policy intends - either term or permanent strategies or some combination of the two. Life insurers use various kinds of term strategies and conventional life plans in addition to "rate of interest sensitive" products which have actually ended up being extra prevalent because the 1980's.

Term insurance coverage offers protection for a specified time period - What is level term life insurance?. This period might be as brief as one year or provide insurance coverage for a specific number of years such as 5, 10, two decades or to a defined age such as 80 or in some instances approximately the oldest age in the life insurance mortality

What is a simple explanation of Compare Level Term Life Insurance?

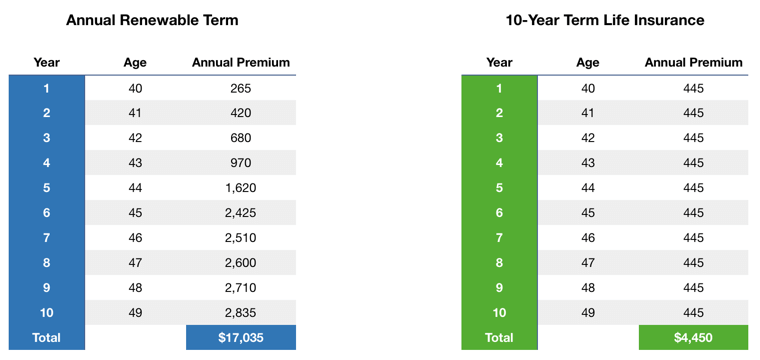

Presently term insurance coverage prices are extremely affordable and amongst the cheapest traditionally skilled. It must be kept in mind that it is an extensively held idea that term insurance is the least costly pure life insurance policy protection offered. One needs to examine the plan terms meticulously to determine which term life alternatives appropriate to meet your particular conditions.

With each new term the premium is raised. The right to renew the policy without evidence of insurability is a vital advantage to you. Or else, the danger you take is that your health and wellness might weaken and you might be unable to acquire a policy at the very same prices or perhaps at all, leaving you and your recipients without coverage.

The size of the conversion period will differ depending on the kind of term policy acquired. The costs rate you pay on conversion is typically based on your "current attained age", which is your age on the conversion date.

What is the process for getting Level Term Life Insurance?

Under a level term policy the face amount of the policy continues to be the very same for the whole period. With decreasing term the face amount minimizes over the period. The costs stays the same yearly. Commonly such plans are sold as mortgage protection with the amount of insurance decreasing as the balance of the home loan reduces.

Generally, insurance providers have not deserved to alter costs after the policy is offered. Since such plans might continue for several years, insurance companies need to use traditional mortality, passion and cost rate estimates in the premium calculation. Adjustable premium insurance coverage, nonetheless, enables insurers to provide insurance policy at reduced "current" premiums based upon much less conventional assumptions with the right to alter these costs in the future.

While term insurance policy is created to provide protection for a defined time period, irreversible insurance policy is designed to provide insurance coverage for your whole life time. To keep the premium rate level, the premium at the younger ages surpasses the actual cost of defense. This extra premium constructs a reserve (cash money worth) which aids pay for the plan in later years as the expense of defense rises above the costs.

Who are the cheapest Level Term Life Insurance Policy Options providers?

With degree term insurance, the expense of the insurance will remain the same (or potentially lower if dividends are paid) over the term of your policy, usually 10 or two decades. Unlike permanent life insurance coverage, which never ever runs out as lengthy as you pay premiums, a degree term life insurance policy will end at some time in the future, commonly at the end of the duration of your degree term.

As a result of this, numerous individuals use permanent insurance as a secure monetary planning tool that can serve many demands. You may be able to transform some, or all, of your term insurance coverage during a collection duration, typically the initial 10 years of your plan, without requiring to re-qualify for coverage even if your wellness has actually altered.

How can I secure Level Death Benefit Term Life Insurance quickly?

As it does, you might desire to include to your insurance policy coverage in the future. As this occurs, you may want to at some point lower your death benefit or think about converting your term insurance to a permanent plan.

So long as you pay your premiums, you can rest easy understanding that your loved ones will certainly obtain a survivor benefit if you pass away throughout the term. Several term plans permit you the capability to convert to long-term insurance without needing to take an additional health test. This can allow you to benefit from the fringe benefits of a long-term policy.

Table of Contents

- – What does Guaranteed Level Term Life Insurance...

- – What is Level Term Life Insurance Protection?

- – Can I get What Is Level Term Life Insurance? ...

- – What is a simple explanation of Compare Level...

- – What is the process for getting Level Term L...

- – Who are the cheapest Level Term Life Insuran...

- – How can I secure Level Death Benefit Term Li...

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Insurance Funeral Plans

Metlife Term Life Insurance Instant Quote

More

Latest Posts

Senior Care Usa Final Expense Insurance Reviews

Insurance Funeral Plans

Metlife Term Life Insurance Instant Quote